Global trends in ultra-precision molding for Diagnostic and Therapeutic Devices

Ultra-precision molding underpins the next generation of diagnostic and therapeutic devices, from microfluidic lab-on-chip cartridges and optical assay windows to microneedle arrays and precision catheters. This article reviews current global trends: technological advances in micro- and nano-replication, materials optimized for biocompatibility and optics, Industry 4.0, enabled process control and in-line metrology, regulatory and supply-chain pressures, and the practical challenges that remain for scaling high-tolerance, high-volume medical parts.

Why ultra-precision matters for medtech

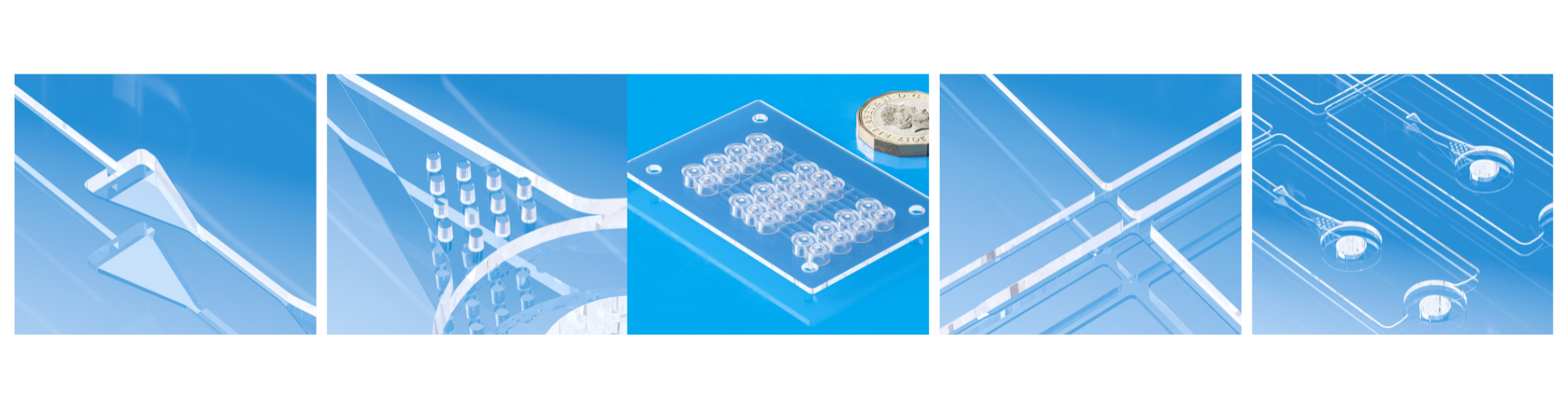

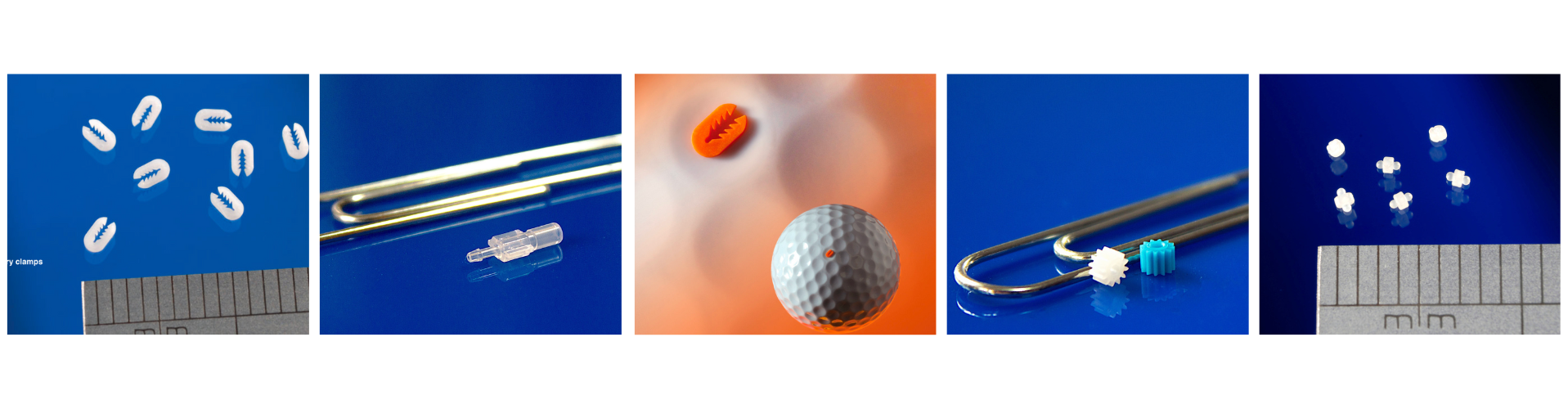

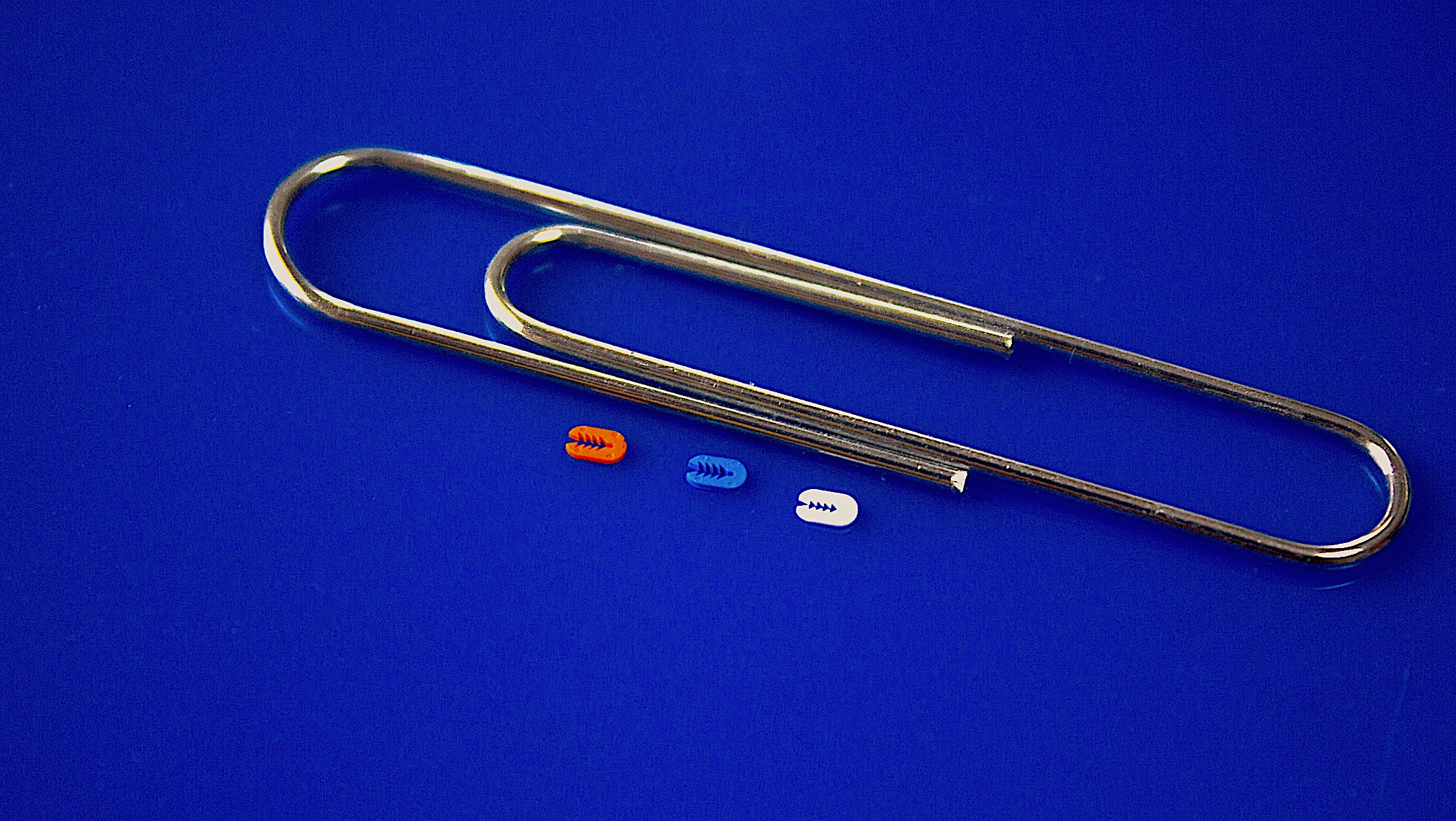

Medical diagnostics and therapeutics increasingly depend on devices with sub-millimetre and micro-scale features such as microchannels in point-of-care cartridges, sub-100 µm microneedles for transdermal delivery, and optical surfaces with nanometre-scale form tolerances. Reproducible replication of such features at scale requires ultra-precision molding techniques, micro injection, liquid-silicone-rubber (LSR) molding, and nanoimprint or hot-embossing, together with rigorous process control and biocompatible materials (Zhang et al., 2022).

Market and application drivers

Three commercial forces are shaping demand:

Point-of-care testing and decentralized diagnostics: miniaturized cartridges and cassettes require tight dimensional control and optical clarity to ensure assay reliability.

Single-use, high-volume disposables: infection-control priorities drive single-use formats, necessitating cost-efficient mass replication with tight tolerances; analysts forecast steady growth for micro injection and medical silicone markets (Mordor Intelligence, 2024; Grand View Research, 2024).

Therapeutics miniaturisation: precision molding enables complex multi-component drug-delivery devices that combine small size with mechanical robustness.

Core technologies and recent advances

Micro injection molding (µIM)

Micro injection molding remains the principal method for producing high-precision polymer micro-features in quantity. Recent process refinements, improved screw/barrel design, high-accuracy mold-temperature control, and advanced insert technologies, reduce feature distortion and improve replication down to the low-micron scale (Zhang et al., 2022).

Liquid-silicone-rubber (LSR) molding

LSR is widely used for soft-touch interfaces, seals and implantable-grade elastomer components because of its biocompatibility, thermal stability and clarity. The LSR market growth reflects rising demand for both disposables and implantable components; production methods now emphasise two-shot and over-moulding flows to combine rigid polymer substructures with precision silicone features (Grand View Research, 2024).

Nanoimprint lithography (NIL) and hot embossing

For nano- to sub-micrometre features such as diffraction gratings or nanopatterned fluid-control surfaces, NIL and hot embossing offer extremely high-fidelity replication from a master template, particularly where optical or surface-relief structures are functionally critical (Li et al., 2023).

Multi-material and multi-shot molding

Two-shot and multi-material molding techniques integrate rigid housings with elastomeric seals or soft user interfaces in a single step, reducing downstream assembly risk and improving part consistency.

Materials trends: optics, biocompatibility and barrier properties

Material choices are pivotal. Traditional engineering plastics such as polycarbonate (PC) and polymethyl methacrylate (PMMA) remain common, but cyclic-olefin polymers (COP/COC) are increasingly adopted where optical clarity, low autofluorescence and chemical resistance are required for microfluidic cartridges and optical windows (Agha et al., 2022). Surface modification, plasma or specialized coatings, can further tune wettability and bonding for downstream assembly. For elastomeric and soft components, medical-grade LSR variants dominate because of regulatory acceptance and performance (Grand View Research, 2024).

Quality control, metrology and Industry 4.0

Ultra-precision molding demands advanced metrology:

In-line and at-line optical metrology: high-speed profilometers and machine-vision systems detect dimensional drift and surface defects during production.

Computed tomography (XCT) and confocal metrology validate internal features where destructive sectioning is unacceptable.

AI and closed-loop control: Industry 4.0 implementations combine sensor data, machine-learning models and OPC UA-based communications to enable predictive maintenance and closed-loop parameter tuning, improving yield and reducing scrap (Schmitt et al., 2023).

Regulatory and sustainability pressures

Manufacturers must satisfy overlapping regulatory frameworks, ISO 13485, EU MDR/IVDR, FDA QSR and UKCA, that govern material selection, traceability, process validation and post-market surveillance. The EU’s Medical Device Coordination Group (MDCG) guidance continues to shape design controls and technical documentation (European Commission, 2023). Environmental standards such as ISO 14001 and industry pressure for sustainable polymers are beginning to affect material choice and process energy optimization.

Supply-chain and manufacturing resilience

Global disruptions have highlighted the need for geographically diversified supply chains and validated second sources for critical materials such as medical-grade polymers and silicones. Many OEMs are relocating precision-molding capacity closer to final markets to reduce lead times and regulatory complexity.

Technical challenges and research frontiers

Key challenges remain:

Feature fidelity versus cycle time: achieving sub-10 µm fidelity often demands slower cooling or variothermal cycles, which conflicts with cost targets for high-volume disposables (Zhang et al., 2022).

Tooling wear and master durability: micro- and nano-structures accelerate tool wear; novel coatings and hard-metallurgy inserts are under active research.

Replication of multi-scale features: devices combining nano-optical structures with millimetre-scale mechanical fittings require hybrid workflows such as NIL plus µIM and precise alignment strategies (Li et al., 2023).

Biocompatible surface treatments: bonding and surface functionalization without compromising assay chemistry remains non-trivial (Agha et al., 2022).

Outlook

The next five years will likely see:

- Expanded AI-driven process optimization to improve yield and enable predictive maintenance (Schmitt et al., 2023).

- Broader adoption of COC/COP and medical-grade LSR for optics and soft interfaces (Agha et al., 2022; Grand View Research, 2024).

- Hybrid replication workflows combining nano- and micro-scale features for cost-effective manufacturing (Li et al., 2023).

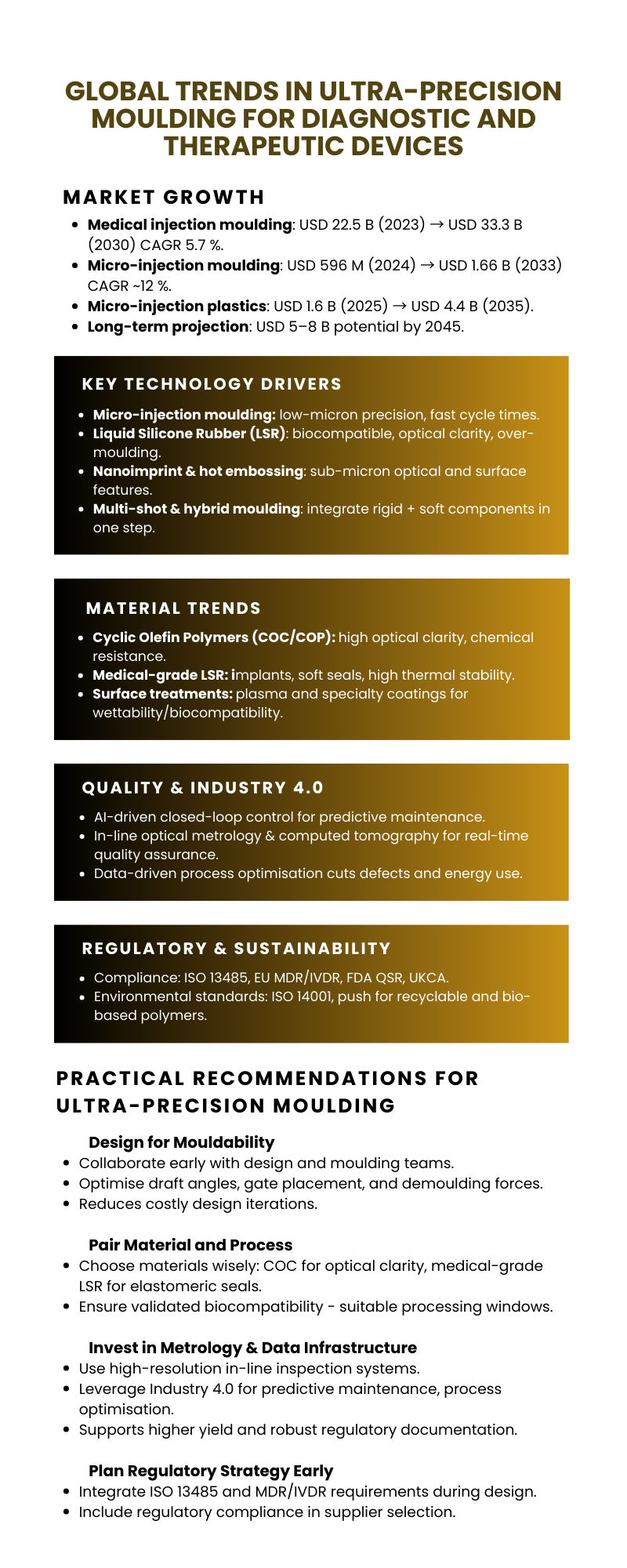

The global medical injection molding market, worth about USD 22.5 billion in 2023, is projected to reach USD 33.3 billion by 2030 at a CAGR of 5.7 % (Grand View Research, 2024). The high-growth micro-injection molding segment is forecast to rise from USD 596 million in 2024 to USD 1.66 billion by 2033, expanding at ~12 % CAGR (Acumen Research & Consulting, 2025). Broader micro-injection molded plastics are expected to grow from USD 1.6 billion in 2025 to USD 4.4 billion by 2035 (Future Market Insights, 2024). Extrapolating these trends, analysts estimate that ultra-precision and micro-molding for medical devices could surpass USD 5–8 billion by 2045, fuelled by rising demand for point-of-care diagnostics, implantable devices and high-volume single-use components (Grand View Research, 2024; Acumen Research & Consulting, 2025).

Practical recommendations

Design for moldability: early collaboration between design engineers and molding specialists reduces costly iterations, consider draft angles, gate placement and demolding forces from the outset.

Pair material and process: select materials such as COC for optical clarity or medical-grade LSR for elastomeric seals with validated biocompatibility and processing windows (Agha et al., 2022).

Invest in metrology and data infrastructure: high-resolution in-line inspection and an Industry 4.0 backbone deliver higher yield and robust regulatory documentation (Schmitt et al., 2023).

Plan regulatory strategy early: integrate ISO 13485 and MDR/IVDR requirements into the design and supplier-selection process (European Commission, 2023).

Ultra-precision molding is central to the evolution of diagnostic and therapeutic devices. Advances in micro- and nano-replication, materials engineered for optical clarity and biocompatibility, and intelligent process control are enabling devices that are smaller, cheaper and functionally richer. Yet the interplay of fidelity, cost and regulation means progress will continue to require close collaboration across design, tooling, materials science and quality systems.

References

Agha, A. et al. (2022) Review of Cyclic Olefin Copolymer Applications in Medical Microfluidics.

European Commission (2023) MDCG Guidance on Medical Device Regulation.

Grand View Research (2024) Medical Silicone Market Size & Forecast 2024–2030.

Li, X. et al. (2023) Nanoimprint Lithography for Biomedical Devices: A Review.

Mordor Intelligence (2024) Micro-Injection Moulding Market – Growth, Trends, Forecast (2024–2029).

Schmitt, T. et al. (2023) Industry 4.0 and Closed-Loop Control in Injection Moulding.

Zhang, H. et al. (2022) A Review of Micro-Injection Moulding of Polymeric Micro Devices.