Building MedTech Molding in Southeast Asia: Hubs, Expertise & Market Advantage

Southeast Asia (SEA) is fast emerging as a major hub for MedTech molding, offering cost efficiency, skilled labour, and strong regulatory support [1]. This article outlines the key manufacturing hubs, their technical expertise, and the market advantages for original equipment manufacturers (OEMs) seeking to establish or expand production in the region.

1. Regional Hubs for MedTech Molding

1.1 Singapore

Singapore is the leading MedTech molding hub in SEA, with manufacturing output growing from US $4 billion in 2012 to over US $19.4 billion in 2023 [2]. It hosts all top 30 multinational MedTech companies and integrates research, advanced manufacturing, and regional headquarters [3].

- Produces 1 in 7 hearing aids, 90% of global gene expression chips, and 10% of contact lenses [4].

- Home to Tuas Biomedical Park, a world-class industrial cluster [5].

- Benefits from 13 Free Trade Agreements (FTAs) facilitating medical exports [6].

1.2 Malaysia (Penang & Beyond)

Malaysia, particularly Penang, has been recognized as a growing MedTech manufacturing hub, supported by government initiatives such as the 12th Malaysia Plan and NIMP 2030 [7]. Penang is often referred to as the “Silicon Valley of the East” due to its strong medical and electronics manufacturing base [8].

1.3 Thailand and Malaysia: ISO-Certified Clusters

Both Thailand and Malaysia host ISO 13485-certified injection molding facilities focusing on high-precision medical components [9]. Penang alone houses approximately 30 medical injection molding companies [10].

1.4 Emerging Centres: Vietnam & Indonesia

Vietnam has strengthened its capabilities with European-standard tooling, strict tolerance levels (±0.001 mm), and defect rates below 100 PPM [11]. Indonesia, Vietnam, and the Philippines are also benefiting from healthcare infrastructure growth and rising MedTech demand [12].

2. Technical Expertise and Infrastructure

2.1 Clean and Precision Production

Singapore offers advanced cleanroom molding capabilities, with leading manufacturers operating in ISO 13485-certified environments and deploying robotic handling systems [13].

2.2 Advanced Manufacturing and Automation

AI-enabled manufacturing plants and Industry 4.0 integration, such as Agilent’s facility with 250 IIoT stations, position Singapore at the forefront of automated MedTech production [14]. Public–private initiatives, including RIE 2025, continue to drive innovation [15].

2.3 End-to-End Value Chain & CDMOs

Contract development and manufacturing organizations (CDMOs) provide design, regulatory, assembly, and post-market services throughout SEA [16]. Malaysia and Thailand offer attractive tax incentives, while Vietnam and Indonesia provide Special Economic Zones (SEZs) [17].

2.4 Innovation & R&D Integration

Around 70% of MedTech manufacturers in Singapore conduct local R&D, supported by S$25 billion in research funding [18]. The region also hosts over 25 R&D centres and 220+ MedTech start-ups [19].

2.5 Supplier Ecosystem & Quality Assurance

Over 2,700 suppliers in Singapore alone contribute to a robust and resilient MedTech supply chain [20].

3. Market Advantages for OEMs

3.1 Strategic Location and Trade Access

Singapore offers excellent global connectivity, with access to 600 ports and over 4,000 weekly flights [21]. Malaysia, Vietnam, and Thailand benefit from regional trade agreements easing medical device exports [22].

3.2 Cost Efficiency and Scalability

SEA provides competitive labor costs combined with ISO-compliant production standards [23]. The Asia-Pacific medical injection molding market is expected to reach USD 14.5 billion by 2030 (CAGR 6.6%) [24].

3.3 Regulatory and IP Stability

Singapore’s Health Sciences Authority (HSA) provides internationally recognized regulatory oversight, while regional localization policies further enhance compliance [25].

3.4 Innovation-Led Differentiation

Material innovation includes biodegradable and biocompatible polymers (PLA, PCL) for implantable and drug-delivery applications [26]. Machine learning-driven cycle optimization is increasingly adopted for efficiency [27].

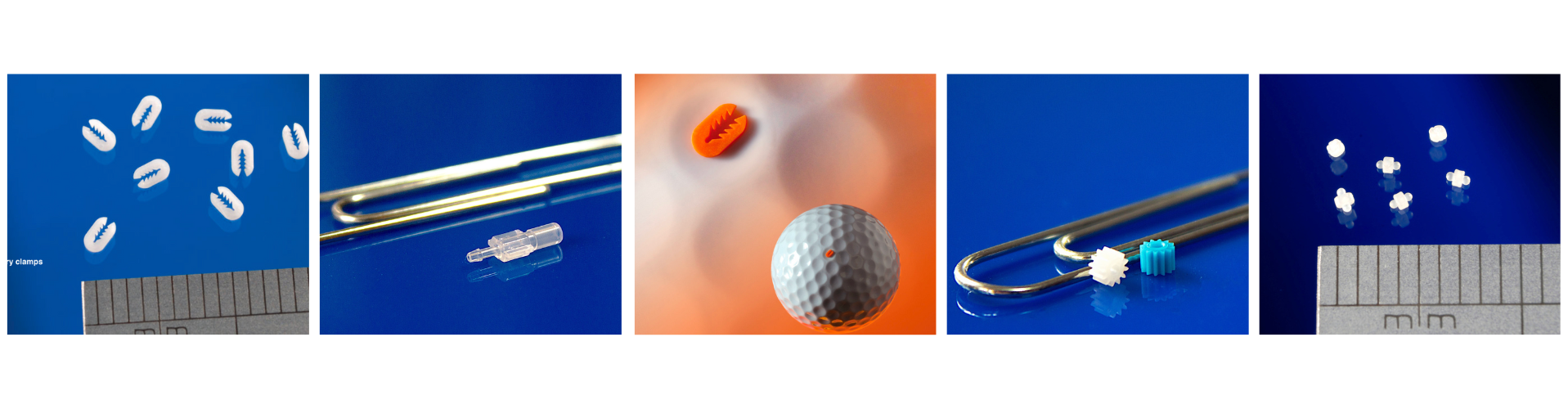

Spotlight: Micro Systems Singapore

Micro Systems Singapore is one of the leading providers of precision mold solutions tailored for the MedTech sector in the region. The company specialises in ultra-fine injection molds (one to multi-cavity) with tolerances as low as 1 μm, supporting minimally invasive surgical tools, diagnostic devices, and implantable components. Micro Systems’ commitment to precision, quality, and regulatory compliance makes it an ideal partner for OEMs seeking high-value, low-volume MedTech manufacturing in Southeast Asia.

Southeast Asia is a growing centre for MedTech molding, with Singapore, Malaysia, Thailand, and Vietnam offering strategic advantages in innovation, cost efficiency, and regulatory compliance. For OEMs targeting global competitiveness, the region offers an ideal platform to anchor advanced manufacturing.

References

[1] EDB Singapore, 2023.

[2] EDB Singapore, MedTech Market Insights, 2023.

[3] MPO Magazine, 2023.

[4] EDB Singapore, 2023.

[5] Tuas Biomedical Park, Singapore.

[6] Singapore FTA Network.

[7] Malaysia MedTech Industry Summit, 2024.

[8] Economy of Penang, 2023.

[9] ISO 13485 Medical Injection Moulding Report, 2024.

[10] Penang Medical Injection Moulding Market, 2024.

[11] Vietnam Injection Moulding Market, 2024.

[12] ASEAN Medical Device Market Opportunities, 2024.

[13] Inzign Services Overview, 2024.

[14] Agilent Singapore Smart Manufacturing Report, 2023.

[15] RIE 2025 Innovation Strategy, Singapore.

[16] L.E.K. MedTech CDMO Overview, 2023.

[17] L.E.K. SEA Manufacturing Incentives Report, 2024.

[18] RIE 2025 Government Funding Announcement.

[19] MedTech Start-up Ecosystem, Singapore 2024.

[20] Precision Engineering Supplier Network, Singapore.

[21] Singapore Logistics Infrastructure Data, 2023.

[22] Regional Trade Agreements, ASEAN, 2024.

[23] SEA Manufacturing Cost Benchmark, 2024.

[24] Grand View Research, 2024.

[25] Health Sciences Authority, Singapore.

[26] Biocompatible Materials Trends Report, 2024.

[27] Machine Learning in Injection Moulding, 2024.